Automating Deferral Schedules with Deferral Defaults in Dynamics 365 Finance

In Microsoft Dynamics 365 Finance, deferral schedules and deferral defaults are standard, key components of the Revenue and Expense Deferrals functionality within the Subscription Billing module.

Deferral schedules allow your organization to manage the timing of revenue and expense recognition effectively. They are especially critical for businesses handling subscription-based services or prepayments, where revenue cannot be recognized immediately upon receipt. Deferral defaults, on the other hand, automate the setup of deferral schedules for recurring transaction types, reducing manual configuration.

Originating Documents

The full set of “originating documents” for creating deferral schedules includes the following. (Deferral schedules can be attached to any of these originating documents):

- Sales order invoices

- Purchase order invoices

- General journal

- Free text invoice

- AP invoice journal

- Project journals (Fee, Hour, Expense)

- Item requirements

- Expense report

- Timesheet

What Are Deferral Schedules?

Within Microsoft Dynamics 365 Finance, deferral schedules define the timeline for spreading revenue or expenses across multiple accounting periods rather than recognizing them all at once when a transaction is posted.

Key Features of Deferral Schedules

Core functions of deferral schedules within D365 Finance include:

Enablement

To use deferral schedules, ensure the Subscription Billing module and the Revenue and Expense Deferrals feature are activated in the Feature Management workspace. Note that this functionality is incompatible with the older Revenue Recognition module—only one can be active at a time.

Creation

Deferral schedules are automatically generated after an originating document (e.g., a sales order, purchase order, or journal voucher) is posted.

Template Types for defining the schedule lines

- Straight-Line: Revenue or expenses are evenly distributed over a set period (e.g., monthly over 12 months). Skipped periods (with zero amounts) can be included in templates for flexibility.

- Event-Based: Recognition occurs based on specific events or milestones, allowing for more customized schedules.

Modification

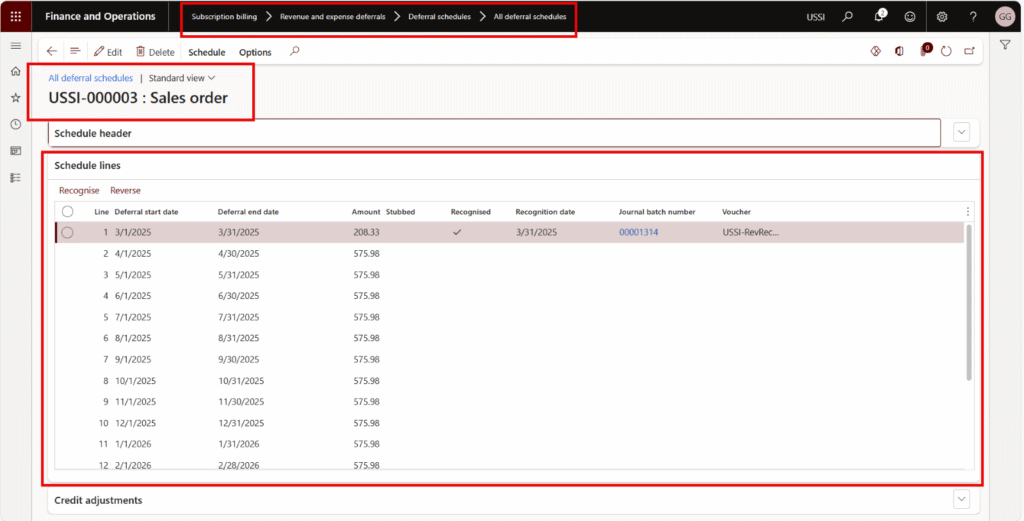

You can view and edit schedules on the All Deferral Schedules or Active Deferral Schedules pages. Adjustments may include modifying unrecognized lines, reversing recognized amounts, or recalculating based on new dates.

What Are Deferral Defaults?

Deferral defaults in Dynamics 365 Finance provide the foundational setup that determines how deferral schedules are automatically applied to transactions. They define default accounts, templates, and calculation rules for deferring revenue or expenses.

Key Features of Deferral Defaults

Configuration

Defaults are configured on the Deferral Defaults page (Subscription billing > Revenue and expense deferrals > Setup > Deferral defaults).

Purpose

- Specifies default deferral accounts (e.g., Deferred Revenue or Prepaid Expenses) and recognition accounts (e.g., Revenue or Expense).

- Links deferral templates to specific items, customers, vendors, or categories to automate deferral behavior.

Granularity

Defaults can be set at multiple levels:

- Item: Specific products or services.

- Group: Item groups, customer groups, or vendor groups.

- Category: Procurement or product categories.

- All: Applies universally if no specific rule exists.

*Financial dimensions (e.g., department, location) can inherit from the customer, vendor, or item.

Templates

Deferral defaults link to deferral templates (straight-line or event-based), which dictate recognition frequency (daily, monthly, fiscal) and patterns (e.g., 12 equal monthly installments).

Automation

When a transaction involves an item or account with a deferral default, the system automatically marks it as deferred and applies the associated template and accounts.

Recognition Processes

Revenue and expenses are typically recognized automatically via period batch jobs. However, deferral schedule lines can also be recognized manually by selecting specific lines and creating a recognition journal.

The Recognition Processing page allows you to set a cutoff date and filter lines for recognition or reversal. Monthly recognition processes reduce deferred balances and ensure revenue/expenses are recognized appropriately over the deferral schedule’s lifespan.

Putting It All Together

By putting simple pieces together, your organization can enable original document transactions to be automatically deferred by default. Later, deferred balances can be reduced while revenue and expenses are given timely recognition.

- Originating Documents are the foundation and provide the baseline accounting activities where deferrals become necessary.

- Deferral Defaults act as the blueprint, defining the “what” (accounts) and “how” (templates) of deferral application.

- Deferral Schedules are the execution, taking the defaults and applying them to specific transactions to create a timeline for recognition.

- Recognition processes work to enable revenue and expense recognition when its needed. Recognition processes are easy to use and commonly done automatically.

Practical Use Cases

- Revenue Deferral-Service Contract: A company receives $2,400 upfront for a two-year service contract. Deferral Defaults assign a 24-month template, and the Deferral Schedule recognizes $100 monthly.

- Revenue Deferral-Subscription: Imagine a company sells a 1200 USD annual subscription on January 1st. Using a straight-line deferral schedule, the system creates a schedule to recognize 100 USD per month for 12 months. The schedule tracks each period’s recognition. You can review or adjust it as needed.

- Revenue Deferral-Software License: A company sets up a Deferral Default for a specific item (e.g., a software license) with a Deferred Revenue account (e.g., 250600) and a Revenue account (e.g., 401200), linked to a 12-month straight-line template. When a sales order for this item is posted, a deferral schedule is automatically created without manual intervention.

- Expense Deferral-Insurance Prepayment: A business prepays $12,000 for a year of insurance. The Defaults link to a 12-month template, and the Schedule amortizes $1,000 monthly to the expense account.

Benefits

- Compliance: Aligns with accounting standards by recognizing revenue and expenses when earned or incurred. The features help to ensure compliance with accounting standards for Revenue recognition like ASC 606 and IFRS 15.

- Automation: Reduces manual work by predefining rules and automating schedule creation. Recognition events can be configured to process automatically.

- Flexibility: Allows customization for different transaction types and recognition patterns.

- Visibility: The All Deferral Schedules form provides a clear view of all deferred transactions and their status. Audit trail features both inside and outside the Subscription billing module are there to back you up.

Limitations

Deferral schedules depend on originating documents and cannot be created independently. If a deferral schedule is missed during initial posting (e.g., for an invoice), it can be created later via a journal entry with supporting documentation.

Conclusion

By leveraging deferral schedules and deferral defaults in Dynamics 365 Finance, businesses streamline financial processes, improve accuracy, and maintain a clear audit trail for deferred transactions. This functionality replaces manual workflows, simplifying deferred revenue and expense management directly within D365 Finance and Operations (F&O).

FAQs

Deferral defaults are predefined rules that determine how deferrals are applied (e.g., accounts, templates), while deferral schedules are the actual timelines created for individual transactions. Defaults automate setup for recurring transactions, whereas schedules execute the deferral by spreading revenue or expenses over time. Think of defaults as the blueprint and schedules as the finished product.

Go to the Feature Management workspace and enable both the Subscription Billing module and Revenue and Expense Deferrals. Note that this feature cannot coexist with the older Revenue Recognition module — only one can be active at a time. Ensure your user role has permissions to access deferral settings.

Yes, you can adjust unrecognized lines or reverse recognized amounts via the All Deferral Schedules page. Changes might include recalculating dates, adjusting amounts, or adding skipped periods. However, recognized amounts require a reversal journal before edits can be made.

Dynamics 365 offers straight-line (equal amounts over fixed periods) and event-based (triggered by milestones) templates. Use straight-line for predictable subscriptions or prepayments, and event-based for irregular revenue/expenses tied to deliverables or project phases.

Recognition typically happens via a periodic batch job that processes deferral lines up to a cutoff date. You can also manually recognize lines from the Recognition Processing page. The system reduces deferred balances and posts to revenue/expense accounts accordingly.

Yes, you can create a deferral schedule later by posting a general journal entry linked to the original transaction. Attach supporting documentation for audit purposes, as deferrals cannot be created standalone — they must tie to an originating document.