Organizations with many legal entities tend to struggle with piles of manual work and errors for accountants to sift through. But with multi-entity accounting software, which includes ERP platforms and third-party tools, you can finally solve multi-currency challenges, centralize financial data across legal entities, and automate tedious intercompany tasks.

Explore the best multi-company accounting software tools and companies below, alongside some key features to look for and tips on how to choose.

At a Glance

- Multi-entity accounting software helps you manage financials across multiple companies, locations, or business units from one system

- Key features include intercompany automation, multi-currency support, and role-based access controls

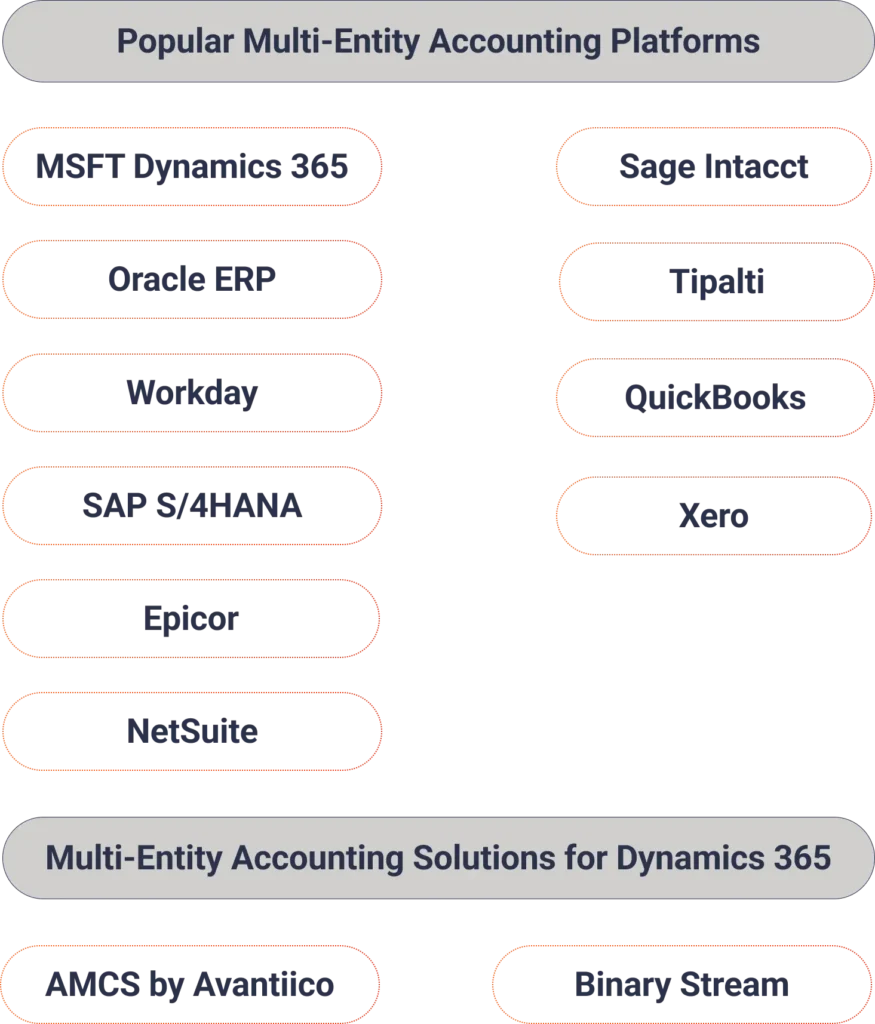

- Microsoft Dynamics 365 Finance & Supply Chain Management (F&SCM), Oracle ERP, Workday, SAP S/4HANA, Epicor, NetSuite, and Sage Intacct are best suited for mid-sized or global companies with more complex needs

- QuickBooks and Xero are designed for small businesses managing multiple ventures

- Add-ons like Tipalti, AMCS by Avantiico, and Binary Stream can extend functionality for AP automation and intercompany management

- These tools reduce manual work, improve accuracy, and speed up month-end close

- Choosing the right platform depends on your structure, growth plans, and how much control and automation you need

What Is Multi-Entity Accounting Software?

Multi-entity accounting software helps businesses centralize and manage accounting and financial reporting across multiple legal entities, subsidiaries, or business units. It gives finance teams the tools to track transactions, automate intercompany processes, and generate both individual and consolidated financial statements — all from a single platform.

This type of software is key for organizations that operate across different regions, currencies, or tax jurisdictions. It usually supports:

- Entity-level reporting with drill-down capabilities

- Consolidated financial views for parent companies

- Automated intercompany eliminations and journal entries

- Multi-currency and multi-tax compliance

- Centralized control with localized flexibility

Multi-entity accounting platforms can range from full-scale ERP systems (like NetSuite or Microsoft Dynamics 365) to more lightweight solutions tailored for smaller businesses or startups with multiple ventures.

By unifying financial data across entities, these tools reduce manual work, improve audit readiness, and give leadership real-time visibility into the financial health of the entire organization.

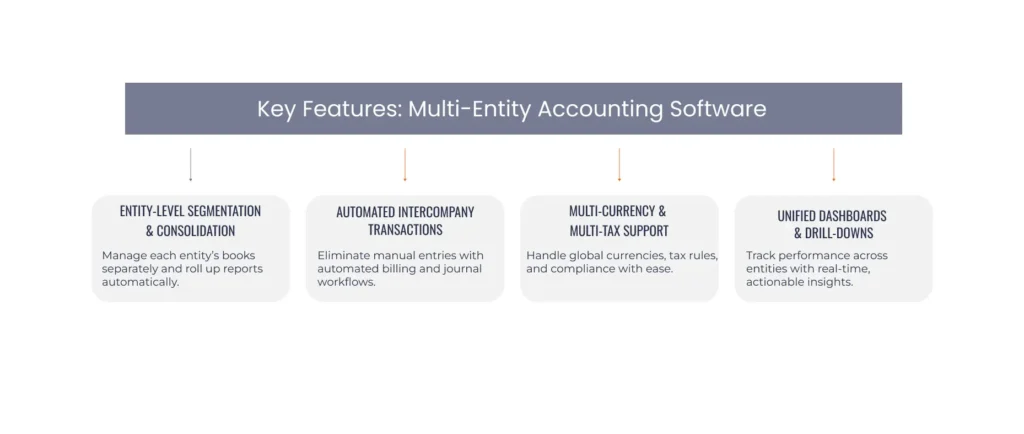

Key Features of Multi-Entity Accounting Software

The best multi-company accounting platforms are built to simplify complexity. Whether you’re managing multiple subsidiaries, franchises, or business units, these platforms offer features that help streamline financial operations while maintaining visibility and control across every entity.

Here are five core features to look for:

1. Entity-Level Segmentation and Consolidation

Top platforms allow you to manage each entity’s books separately while automatically rolling up data into consolidated financial reports. This dual-layer visibility supports both granular oversight and high-level strategic planning without the chore of manual reconciliation.

2. Automated Intercompany Transactions

Multi-entity systems also typically automate intercompany billing, eliminations, and journal entries. This reduces errors, ensures compliance, and saves time during month-end close. Look for tools that support real-time syncing between entities and customizable rules for intercompany workflows.

3. Multi-Currency and Multi-Tax Support

If your entities operate across borders, your software should handle currency conversions, local tax rules, and global compliance requirements. Leading platforms offer built-in support for exchange rates, VAT/GST, and regional reporting standards.

4. Custom Approval Workflows and Role-Based Access

Complex multi-entity organizations often have layered approval chains. To prevent bottlenecks, the best tools let you define custom workflows by entity, department, or transaction type — ensuring the right people review the right data. Role-based access controls also help maintain data security and audit readiness.

5. Unified Dashboards with Drill-Down Reporting

Modern platforms provide real-time dashboards that combine high-level KPIs with the ability to drill into individual entity performance. This empowers finance leaders to spot trends, flag anomalies, and make informed decisions across the entire organization.

The Best Multi-Entity Accounting Software in 2025

Microsoft Dynamics 365 Finance & Supply Chain Management

Microsoft Dynamics 365 Finance (D365 F&SCM) offers foundational multi-entity and intercompany accounting features, but these capabilities can be limited for organizations managing complex financial structures. To address this, Avantiico’s AMCS — a native ISV solution embedded within D365 Finance & Supply Chain Management — enhances automation across multi-company accounting, streamlining intercompany transactions, allocations, and financial consolidation for high-volume, multi-entity environments.

Best for:

Mid-sized to large enterprises with complex operations and a need for tight integration across finance and supply chain

Price Range:

$$ -$$$

Oracle Cloud ERP

Oracle Cloud ERP offers a comprehensive, modern financial platform with native support for complex multi-entity and global operations. Its strengths lie in real-time consolidation, advanced revenue management, and compliance for large enterprises. As part of the broader Oracle Fusion suite, it provides seamless integration with HR, SCM, and CX, making it ideal for large organizations seeking a unified, scalable system for global finance.

Best for:

Large global enterprises requiring a full-suite, integrated business platform

Price Range:

$$$

Workday

Workday is a unified, cloud-native platform for financial management and human capital management (HCM), with strong native support for multi-entity structures. Its core strength lies in automating and streamlining intercompany transactions, consolidations, and reporting across legal entities within a single system. While renowned for its HCM capabilities, its financial module is designed for large enterprises that require real-time visibility and seamless integration between their workforce data and financials, eliminating the need for complex integrations between separate systems.

Best for:

Large enterprises seeking a fully integrated HCM and financial management system in the cloud

Price Range:

$$–$$$

SAP S/4HANA

SAP S/4HANA is designed for large, multinational corporations, offering real-time multi-entity processing and consolidation on a single in-memory database. It handles complex legal and managerial reporting structures, global tax compliance, and intercompany reconciliations at an enterprise scale. While offering unparalleled depth and control, its implementation is a significant undertaking best suited for organizations that require its level of power and global reach.

Best for:

Multinational corporations with the most complex global financial structures

Price Range:

$$–$$$

Epicor

Epicor ERP delivers industry-specific multi-entity capabilities tailored for manufacturing, distribution, and retail sectors. It supports complex intercompany processes, centralized inventory management, and consolidated financial reporting across diverse legal entities. The system is built to handle the intricate needs of global supply chains and project-based operations. While highly powerful, its implementation is best suited for established businesses that require deep operational integration alongside financial control.

Best for:

Established manufacturing and distribution companies with complex global operations

Price Range:

$$-$$$

NetSuite

NetSuite’s OneWorld module is purpose-built for global, multi-entity organizations. It supports multi-book accounting, real-time consolidation, and compliance with international tax and reporting standards. With customizable dashboards and deep ERP functionality, NetSuite is ideal for companies seeking a scalable, all-in-one financial management system.

Best for:

Mid-sized to large enterprises needing global scale

Price Range:

$$

Sage

Sage Intacct offers strong multi-entity functionality with a simplified chart of accounts and dimensional reporting. It supports both individual and consolidated views, making it easier to manage financials across subsidiaries. Sage is a great fit for growing companies that need more structure than entry-level tools but aren’t ready for a full ERP.

Best for:

Mid-sized businesses seeking flexible, cloud-based accounting

Price Range:

$–$$

Tipalti

Tipalti is a robust AP automation platform with advanced multi-entity support, global payments, and compliance features. It integrates with ERPs like NetSuite and Sage Intacct, offering capabilities like automated invoice processing, supplier onboarding, and FX management. Tipalti is ideal for finance teams looking to streamline payables across multiple entities and geographies.

Best for:

High-growth companies focused on AP automation and global payments

Price Range:

$–$$

QuickBooks

QuickBooks supports multi-entity management through separate company files, each requiring its own subscription. Users can toggle between entities using a single login, making it easy to manage multiple businesses from one dashboard. While QuickBooks lacks native consolidation features, it integrates with third-party tools to support reporting across entities. It’s a popular choice for small businesses and startups with straightforward accounting needs.

Best for:

Small businesses with basic multi-entity needs

Price Range:

$–$$

Xero

Xero allows users to manage multiple businesses under one login, with each entity requiring a separate subscription. While it doesn’t offer native consolidation, Xero integrates with apps that extend its multi-entity capabilities. Its clean interface and unlimited user access make it a strong option for small businesses and multi-venture entrepreneurs.

Best for:

Small businesses and startups with multiple ventures

Price Range:

$

Multi-Company Accounting Solutions for Microsoft Dynamics 365

For organizations running Microsoft Dynamics 365 Finance or Business Central, native multi-entity capabilities can be limited. Fortunately, specialized add-ons like AMCS by Avantiico and Multi-Entity Management by Binary Stream extend D365’s functionality to support complex, multi-company financial operations.

AMCS by Avantiico : Best for High-Volume Journal Transactions & Faster Month-End

AMCS (Advanced Multi-Company Solution) is a native extension for Dynamics 365 Finance & Supply Chain Management that automates and simplifies multi-entity accounting. Available in both Lite (free) and Premium versions, AMCS helps finance teams eliminate manual journal entries, streamline intercompany transactions, and accelerate month-end close — all within the D365 environment.

While Microsoft’s recent updates improve multi-company usability within select modules like Fixed Assets, they don’t yet address the broader automation and cross-entity reporting needs that AMCS is purpose-built to solve.

Key features include:

- Super Journal Automation: Post across multiple legal entities from a single interface

- One-Click Imports: Validate and post high-volume journals with minimal effort

- Power Automate Integration: Route approvals and attachments through Teams or Outlook

- Real-Time Consolidation: Gain visibility across all entities without leaving D365

- Rapid Setup: Install and configure in under an hour

AMCS is ideal for companies looking to scale their financial operations without switching platforms or relying on external tools.

Binary Stream: Best for Multi-Entity Billing

Multi-Entity Management (MEM) by Binary Stream is a powerful add-on for Microsoft Dynamics 365 Business Central. It centralizes financial operations across all legal entities, enabling seamless intercompany transactions, real-time consolidated reporting, and scalable security — all from a single D365 instance.

MEM is especially valuable for organizations with complex structures, international operations, or high transaction volumes that need to maintain accuracy and compliance at scale.

For Smaller Businesses & Multi-Venture Entrepreneurs

Managing multiple businesses doesn’t always require enterprise-level software. These tools offer the flexibility and simplicity that small teams and solo founders need to stay organized and in control:

- QuickBooks

- Xero

- Zoho Books

- FreshBooks

Common Use Cases for Multi-Entity Accounting Software

Multi-entity accounting software is designed to solve complex financial challenges that arise when managing multiple business units, subsidiaries, or brands. Here are two common scenarios where these tools deliver significant value:

Managing Financials Across Franchises or Business Units

Franchise operators and multi-brand companies often need to maintain separate books for each location or entity while still reporting on overall performance.

Multi-entity accounting software enables centralized oversight with decentralized control, allowing each unit to operate independently while rolling up data into a unified financial view. This is especially useful for businesses with varying ownership structures or performance metrics across locations.

Consolidating Global Subsidiaries with Different Currencies and Tax Rules

For companies with international subsidiaries, managing multiple currencies, tax jurisdictions, and compliance requirements can be overwhelming. Multi-entity platforms simplify this by automating currency conversions, applying local tax rules, and generating compliant reports for each region.

At the same time, they provide consolidated financial statements that reflect the organization’s global financial health, all without manual reconciliation.

How to Find the Best Multi-Entity Accounting Software for Your Org

Choosing the best multi-entity accounting software depends on how complex your business is, how many entities you manage, and what level of control and visibility you need. At a high level, look for tools that simplify your workflows, support growth, and give you a clear financial view without adding more manual work.

Here’s a more detailed breakdown of what to look for:

1. Built-In Multi-Entity Support

Your software of choice should be able to handle multiple companies, locations, or business units with separate books and shared oversight.

2. Consolidated & Entity-Level Reporting

You should also be able to view each entity on its own and also roll everything up into one clear financial picture.

3. Intercompany Automation

Shortlist tools that automate intercompany transactions, eliminations, and journal entries to reduce errors and speed up close.

4. Multi-Currency & Tax Compliance

If you operate globally, it’s important that your platform supports currency conversion, local tax rules, and international reporting standards.

5. User Access & Approval Controls

Role-based permissions and custom approval workflows help you stay secure and compliant across all entities.

6. Integration with Your Existing Tools

Evaluating how well new software integrates with your existing tech stack is critical. Without seamless integration, you risk data silos, process delays, and a stalled rollout. Choose a platform that plays well with your ERP, CRM, and AP tools and validate compatibility early with a structured business solution or ERP Evaluation.

7. Scalability & Cost Fit

Lastly, make sure the solution fits your current budget, but can also grow with you as you add more entities or expand internationally.

The core idea being: the right platform should reduce complexity, not add to it, and scale without bottlenecks. Focus on what your team needs today, but also think about what you’ll need once you’re twice the size.

Closing Thoughts

Choosing the right multi-entity accounting software, like any new tool, isn’t just about features. You need a tool that fits your org’s structure, growth plans, and workflows. In this guide, we’ve covered what this type of software is capable of and looked at some key features and use cases so that you have a solid starting point.

We also compared leading platforms like QuickBooks, NetSuite, Xero, Tipalti, and Sage, and highlighted how Microsoft Dynamics 365 users can extend their capabilities with powerful add-ons like AMCS by Avantiico and Binary Stream’s Multi-Entity Management.

Now, it’s up to you to match your options to your business needs, AKA perform a needs assessment or analysis and start comparing.

If you’re unsure how to get started with the evaluation and selection process, contact us and one of our ERP consultants will be in touch.

FAQs

Multi-company accounting refers to managing the financials of multiple legal entities, business units, or locations under one umbrella. It involves keeping separate books for each entity while also being able to consolidate reports, automate intercompany transactions, and maintain compliance across the board.

Multi-entity accounting lets you manage multiple companies or business units, each with its own books. Multi-currency accounting allows you to handle transactions in different currencies. Many businesses need both — especially if they operate internationally — but they solve different problems.

Not necessarily. While ERPs like NetSuite or Dynamics 365 offer built-in multi-entity features, smaller businesses can use tools like QuickBooks or Xero with third-party integrations. The right choice depends on your size, complexity, and how much automation you need.

Look for features like separate books per entity, consolidated reporting, intercompany automation, multi-currency support, and strong user access controls. Integration with your existing tools and the ability to scale as you grow are also key.

No — many small businesses and solo founders use multi-entity tools to manage multiple ventures. Platforms like Xero, Zoho Books, and QuickBooks are accessible and flexible enough for smaller teams.

QuickBooks doesn’t offer native financial consolidation. You’ll need to use third-party tools or export data to Excel to create consolidated reports. For more advanced consolidation, platforms like NetSuite or Sage Intacct are better suited.

FreshBooks is designed for freelancers and service-based businesses, and while you can manage different clients or projects, it doesn’t support true multi-entity accounting. If you need to manage separate books for multiple companies, you’ll need to create separate accounts — or consider a platform built for multi-entity use.